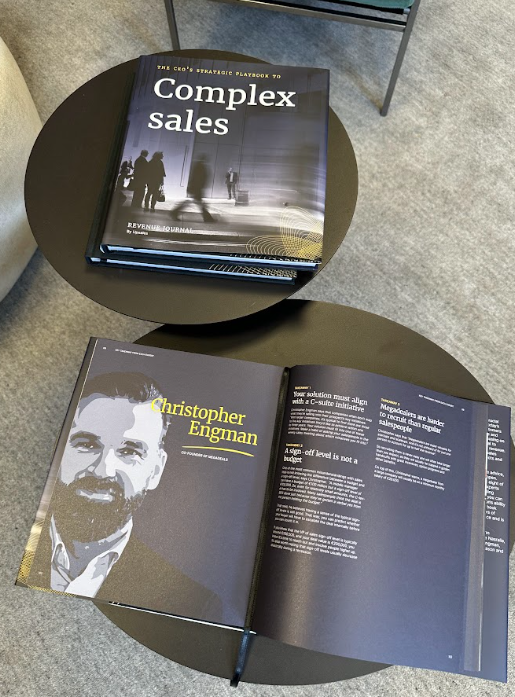

He is the co-founder of Megadeals and author of the book with the same name. The Megadeals discipline involving over 100 Fortune 500 companies and in-depth interviews with over 60 highly successful megadealers.

Christopher is also one of the featured experts in our newly released "The CEO's Playbook to Complex Sales". Here are his top three takeaways from his contribution.

1 / Your solution must align with a C-suite initiative

Many companies don't map their solution into their prospect's key initiatives.

With larger companies, that's a must.

There are typically three to five initiatives they'd like to achieve within 1-3 years.

Make a habit of asking your salespeople in the weekly sales meeting about which initiatives you fit into.

2 / A sign-off level is not a budget

One of the most common misunderstandings is sales reps not knowing the difference between a budget and a sign-off level.

A middle manager can have a budget of €100 million but a sign-off level of €100K.

So, even for relatively small amounts, the C-level needs to be involved.

Many salespeople think the deal is 90% done just because they've received a verbal yes from the person holding the budget.

Having a good sense of typical sign-off levels will help you determine when to escalate them internally before counting the deal in.

3 / Megadealers are harder to recruit than regular salespeople

Megadealers are super valuable.

In startups and scaleups, it's not unheard of for just one person to account for up to half the revenue.

So recruiting them is hard. And they're often trapped in golden handcuffs with great incentives, option programs and other benefits.