You’re the CEO of a SaaS business with 5,000 customers. You’ve overseen an average 10% rise in subscriptions year-on-year since launching four years ago. Meanwhile, your revenue has also been growing. By way more than 10% over the same period.

So what in the name of SaaS is going on?

The answer can be found in Net Revenue Retention (NRR). It turns out that of your 5,000 customers, many are upgrading plans, purchasing add-ons, and buying more licences. As a result, you’re looking at 100%+ revenue retained from existing customers.

“Yes, we all now know top SaaS leaders have world-class NRR, from 110% to 160%.”

The NRR story is crucial for SaaS companies (and investors). That’s because it’s a metric that doesn’t just show how your business is expanding. NRR also shows the sustainability of that expansion amid challenges such as churn.

What is NRR? A definition

First, let’s look at how and what is calculated. NRR gives insight into how much revenue you’ve generated from:

Existing customers’ ARR… plus renewals, upsells, cross-sells, and extra products…

…minus cancellations, downgrades, pauses to accounts

The equation means that when NRR hits 100%+, the business is growing without having to bring in a single new customer.

NRR: Metric for momentum

As the formula above shows, NRR gives you a wider view of your business. Alongside churn-related metrics, you’re also gaining insights into adoption and expansion. Put everything together and NRR becomes a method to:

- Measure the total value of renewed or downgraded contracts. NRR helps you gain a full understanding of where you’re making gains (or losses).

- Identify which customers generate the most revenue. NRR shows you where you’re having upselling success — and where further revenue opportunities may exist.

- Understand the impact of customer churn. NRR reveals whether you’re focusing too much on converting new leads — instead of nurturing existing customers.

Of course, NRR isn’t a replacement for other metrics crucial to fast-growing scale-ups. For example, a business may have high NRR — and also a high churn rate and high Customer Acquisition Costs. This would suggest a problem with a business’s underlying dynamics and longer-term risk. And that would make many potential investors wary.

However, NRR can also answer a question that’s crucial for your business — and investors. “What would your yearly revenue be if you didn’t add a single customer during the year?” Let’s say your revenue still grows, and your churn and CAC are under control. Your business is then building up serious momentum.

Snowflake posted 158% NRR in 2020, the same year it floated in the “largest initial public offering ever for a US software company”.

How to boost NRR & scale faster

Start by dividing your customers into three main segments:

- Churned customers

- Little or no growth

- High growth

Segments 1 and 3 are where the biggest NRR gains are to be found.

Setting up a cancellation task force

For churned customers, segment into:

- Has cancelled before subscription renewal is due (not yet churned)

- Has cancelled and their subscription has expired

- Then create a task force for customers who have not yet churned.

Depending on your resources, this will involve a mix of people and automated workflows. Ready to deploy whenever a customer clicks the cancel button. Some recommended tactics include:

- Immediate surveys or meeting requests to find out why

- Reminders of your value proposition, through messaging sequences and cancellation pages

- Show your release roadmap (for customers who feel they’ve outgrown your offering)

- Upsell-related offers (such as extra features, rather than offering discounts) to stay or to pause for a period of time

- Expanding your tiers (for customers whose business model may have changed)

- Offer further training with your customer experience team

Identifying high-growth customers

Crunch your customer data on each of the three segments. There will be patterns and recurring themes you can work with. Start by looking at:

- Industry

- Company size

- Product/service used

- Problems they wanted to solve

Case study: Upsales

Let’s go straight to the source for how this works in practice. Here’s the data from a segmentation we did a while back at Upsales. Feel free to use and adapt to suit your business.

Step 1: Split customers we closed into 3 tiers of ARR

Over the period Q2 2020 to Q1 2021, we brought in 369 new clients in total that we sorted by deal size in terms of ARR. We had a hypothesis that we needed clients to be above a certain level in terms of ARR for our land and expand strategy to work. And instead of guesswork, we took a close look at the data by segmenting new customers into three tiers.

- Micro clients — 150 — initial ARR less than €1200

- Tiny clients — 75 — initial ARR between €1200-€2500

- Growth prospects — 144 — initial ARR above €2500

Conclusion: More than 60% of the clients we sold to were below the growth prospect tier.

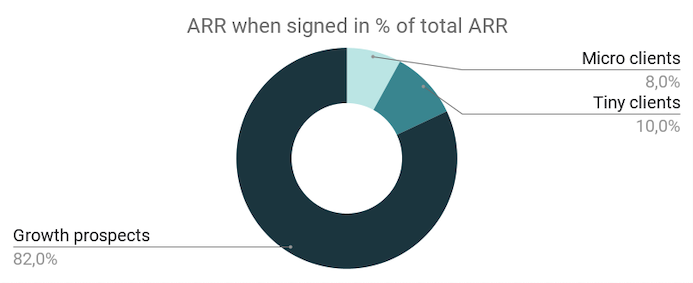

Step 2: Analyse total ARR from the three segments (when signed)

We wanted to understand how important each tier was for our overall ARR growth. It turned out that a large amount of the customers contributed to very little revenue. A classic example of the Pareto principle.

Step 3: Analyse first-year churn

Our experience tells us that reducing churn starts with selling to the right customers in the first place. And when we looked at churn for the three tiers the data was very clear. The small customers had a 3X higher first-year churn rate compared to the third tier.

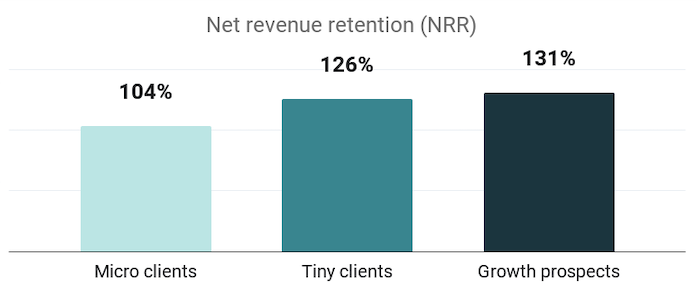

Step 4: Analyse share of first-year expansions

But what if the smallest tier had super-high growth? We looked at the first-year expansions for the three tiers.

- Micro clients: 800 € — 1000 €

- Tiny clients: 1700 € — 2500 €

- Growth prospects: 6800 € — 9500 €

An increase by 49K or 39%.

In absolute numbers, the first-year expansion for a growth prospect was 25 times higher than for the smallest tier. The numbers may speak for themselves. High-growth clients = less churn and more ARR. However, there’s plenty more happening “under the bonnet”.

Longer-term, filtering best-fit customers is about balance. Between reducing sign-up friction and increasing sign-up qualification. It also involves plenty of resources, discussion, and alignment between sales and marketing. However, companies that identify best-fit customers will reap the NRR rewards.

Naturally, the process involves identifying and moving on bad-fit customers. While this takes careful planning, in our case it freed up around 60% of our time. That’s how long we were spending trying to make bad-fit become best-fit. The process also involved adding value to services for our high-growth customers. This meant we could replace and expand the revenue that had been coming from our departed bad-fit customers.

The NRR mentality

All in all, it’s about adopting an account-based approach to driving your NRR. The sort of strategy you probably used to acquire many of your customers. It’s just that now you also have data on those customers. Understanding this data makes it easier to retain the right customers. And by the “right” customers, that means those who are open to upgrades, upsells, and ultimately boosting your NRR.

/ Daniel Wikberg

CEO & Founder of Upsales